What Will it Take to Kick-Start the Real Estate Market?

News, Personal

The real estate market in and around the GTA has shown some fluctuating trends over the past 12 months. While interest rates in Canada have eased from their post-pandemic highs, offering some relief to prospective buyers, the average prices…

What Will it Take to Kick-Start the Real Estate Market?

News, Personal

The real estate market in and around Hamilton and the GTA has shown some fluctuating trends over the past 12 months. While interest rates in Canada have eased from their post-pandemic highs, offering some relief to prospective buyers, average…

THE GROWTH OF ADDITIONAL DWELLING UNITS IN SOUTHERN ONTARIO

home, News

Southern Ontario is witnessing a dramatic shift in housing preferences, with additional dwelling units (ADUs) emerging as a popular solution to affordability, sustainability, and speed of construction. ADUs can include triplexes, fourplexes,…

Meet The Real Estate Team: Every Avenue

News

On June 5th, the team at Every Avenue Real Estate officially opened their doors to the community with Summer in the Square — a vibrant outdoor event that celebrated connection, creativity, and community giving in Downtown Oakville.

Hosted…

WHY THE BANK OF CANADA’S RATE PAUSE ISN’T A GREEN LIGHT FOR CHEAP MORTGAGES

News

If you’ve been waiting for interest rates to drop before locking in a mortgage, you’re not alone. On June 5, 2025, the Bank of Canada (BoC) decided to hold its overnight lending rate at 4.75%, marking the first pause in rate reductions…

TOP RENOVATION TRENDS FOR 2025

News

As homeowners continue to look for ways to enhance their living space, the trend this year is to keep affordability and style in mind. Whether it's a full-scale renovation or refreshing a small space, we're seeing a blend of openness, sustainability,…

FIXED-RATE VS ADJUSTABLE-RATE: WHICH MIGHT BE RIGHT FOR YOU?

News, PersonalAs a mortgage broker here in Canada, I know that diving into the world of mortgages can feel like stepping into a labyrinth of numbers and jargon. In this article, I will explore two of the most common mortgage options in Canada: fixed-rate…

HOW REMOTE WORK IS SHAPING THE CANADIAN MORTGAGE AND REAL ESTATE LANDSCAPE

News

In recent years, we’ve witnessed a seismic shift in our work lives, notably the rise of remote work brought about by the COVID-19 pandemic. This change isn’t just about swapping office desks for dining tables; it’s profoundly impacting…

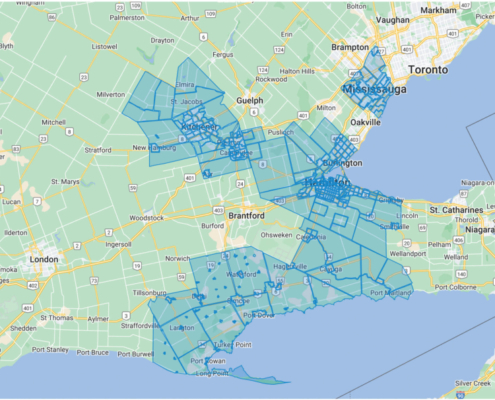

INTRODUCING THE CORNERSTONE OF ASSOCIATING REALTORS: REALTOR’S TOGETHER, STRONGER TOGETHER

News, Realtor

What started as an idea to amalgamate the Realtors Association of Hamilton-Burlington (RAHB) and Waterloo Region Association of Realtors (WRAR) soon caught wind and spread like all good ideas often do. Julie Sergi, a realtor with RAHB for 19…

GOVERNMENT’S NEW HOUSING RULES: A BOOST FOR FIRST-TIME HOME BUYERS OR A RECIPE FOR HIGHER PRICES?

News, Personal

The Federal Government announced in September that, in addition to the new 30-year amortization option for first-time homebuyers of new builds (which took effect August 1st), they will also extend this option to first-time buyers of resale…

WITH A LOWER INTEREST RATE, IS NOW A GOOD TIME TO REFINANCE YOUR MORTGAGE?

News, PersonalWith interest rates dropping, many homeowners ask the same question: Is now the right time to refinance my mortgage? The simple answer? It could be! But as with most financial decisions, a few factors must be considered to ensure it’s your…

OUR AGING POPULATION: HOUSING OPTIONS AVAILABLE NEAR YOU

News, PersonalRetirement is around the corner for many in Canada today, with a quarter of the demographic falling into the senior category by 2030. While so much of the population is hitting this milestone, their housing options may differ from what they…

WHERE ARE THE BUYERS COMING FROM? REALTORS SHARE THEIR INSIGHTS

NewsIt’s no secret that the dream of buying a home is becoming harder for many families and first-time homebuyers, yet the housing market is still doing well, and homes are still selling at all price points. It begs the question: Who are the buyers?…

UNDERSTANDING CHANGES TO THE CAPITAL GAIN TAX

News, PersonalThe 2024 federal budget recently announced a change to the capital gains tax, which caused concern for Canadians who own multiple properties. While the Liberal government has indicated that the new plan is aimed at the wealthy and that 99.87…

HELP (AND HOPE) FOR FIRST-TIME HOME BUYERS

News, PersonalThe recent federal budget announced several plans to tackle the housing and affordability crisis. Several initiatives were included to assist first-time homebuyers in saving and affording a house in the current market climate. Other plans to…

THE IMPACT OF CANADIAN ECONOMIC TRENDS ON THE IMPACT OF CANADIAN MORTGAGE RATES: WHAT YOU NEED TO KNOW

NewsNavigating the world of mortgages can sometimes feel like trying to predict the

weather in Canada: just when you think you’ve got it figured out, things change.

But unlike the weather, understanding the economic factors that influence

mortgage…